Blockchain

Research Lab

Consultation, Research and Service Referral for Payments and Asset Distribution Continuation Planning.

- Digital Asset

- Fiat Payments

- Payments Continuation Planning

- E-commerce

- Websites: Web2 & Web 3

- Custody

The importance of Payments and Asset Distribution Continuation Planning. What is it, why is blockchain important, and how can this help my business.

The Importance of Payment Continuation and Asset Distribution Planning: Payment continuation and asset distribution planning is the proactive approach to ensure a business’s ability to send and receive payments remains intact, even in the face of disruptions. It also involves efficient asset distribution to ensure business operations continue smoothly.

Addressing the Accessibility Gap: Businesses Without Access to Payment Services

The digital age has ushered in unprecedented convenience in payments, but a significant portion of businesses worldwide still lacks access to essential payment services. This report sheds light on the extent of this issue and its implications.

10 Reasons Why Your Bank and Payment Systems Could Be at Risk of being Canceled

In today’s interconnected financial world, the stability and continuity of bank and payment systems are crucial for businesses and individuals alike. However, there are various factors that can lead to the cancellation or disruption of these systems.

Size of Fiat and Stable Coin Blockchain Transactions

According to a report by Chainalysis, the use of stablecoins for payments has been increasing rapidly. In Q1 of 2021, the total value transferred using stablecoins was over $685 billion, compared to $577 billion for Venmo and $342 billion for PayPal. This is a clear indication that stablecoins are gaining popularity as a payment method.

In the past, one of the biggest drawbacks of cryptocurrencies was their volatility. The value of cryptocurrencies could fluctuate dramatically in a short period, making them a risky proposition for merchants and consumers.

About US

We are a Research Team that firmly believe that facilitating access to assets and enabling seamless financial transactions is of paramount significance for both individuals and businesses.

This access ensures their security and undistracted focus on achieving business success.

The inability to send or receive payments can be likened to a critical deficiency in a human body’s ability to breathe. In today’s modern landscape, payments serve as the lifeblood, sustaining the vitality of both individuals and businesses.

Our journey commenced six years ago, driven by the realization that a considerable segment of the population was marginalized from the economic ecosystem of payments, asset distribution, payments continuation planning due to limited knowledge and opportunities. Through an exhaustive exploration of legal frameworks governing asset distribution, we identified innovative solutions. These solutions empower individuals and forward-thinking enterprises to partake in legitimate economic activities and global commerce via a robust online economic platform.

Over the past six years, we have diligently researched and developed cutting-edge technologies, including blockchain payment systems, digital asset trading, e-commerce solutions, website development, web 3 integrations, and trade finance innovations. At present, we are witnessing a convergence between traditional payment and e-commerce systems and the burgeoning blockchain-based alternatives. Our expertise lies in offering comprehensive knowledge and system integration services that grant your business access to both conventional fiat and emerging blockchain digital assets, thereby fostering growth and adaptability.

Research and Consultation Services

For Research Services contact us directly here

Our Focus

Fiat Payment and E-commerce Systems

Fiat merchant services and e-commerce solutions are indispensable for businesses in today’s digital landscape. These services provide a seamless platform for conducting transactions, enabling companies to reach a global customer base. The convenience of online payments not only enhances customer satisfaction but also fosters trust and loyalty. Furthermore, e-commerce platforms offer valuable insights through data analytics, aiding in strategic decision-making and targeted marketing. In a world driven by convenience and accessibility, businesses that embrace fiat merchant and e-commerce services are better positioned for growth, profitability, and long-term success, ensuring their relevance and competitiveness in the modern marketplace.

Website Design Web2, Web3 and Development

Fiat merchant services and e-commerce solutions are indispensable for businesses in today’s digital landscape. These services provide a seamless platform for conducting transactions, enabling companies to reach a global customer base. The convenience of online payments not only enhances customer satisfaction but also fosters trust and loyalty. Furthermore, e-commerce platforms offer valuable insights through data analytics, aiding in strategic decision-making and targeted marketing. In a world driven by convenience and accessibility, businesses that embrace fiat merchant and e-commerce services are better positioned for growth, profitability, and long-term success, ensuring their relevance and competitiveness in the modern marketplace.

Blockchain Digital Payment Systems, Stable Coins, Trade Finance and Exchange for Business Continuity Planning

Blockchain-based digital payment systems, stable coins and exchanges have become indispensable tools for businesses, offering numerous advantages while serving as a crucial backup in case traditional fiat systems or banks cancel services.

The estimated size of digital asset payments for international transactions

With the increasing globalization of businesses and individuals, cross-border payments have become a crucial aspect of international trade. However, traditional methods of making international payments can be slow, expensive, and prone to errors. Cryptocurrencies have emerged as a potential solution to these problems, offering fast, secure, and cost-effective payment options for international transactions. In this introduction, we will explore the estimated size of crypto payments for international transactions.

The benefits of fully audited gold-backed stable coins

With the growing popularity of stablecoins, which are cryptocurrencies pegged to the value of another asset, such as the US dollar, there has been a rise in the demand for stablecoins that are backed by tangible assets such as gold. Gold-backed stablecoins offer investors the benefits of both the stability of a pegged asset and the security and intrinsic value of gold. In this introduction, we will explore the benefits of fully audited gold-backed stablecoins.

The estimated size of digital asset payments for international transactions

With the increasing globalization of businesses and individuals, cross-border payments have become a crucial aspect of international trade. However, traditional methods of making international payments can be slow, expensive, and prone to errors. Cryptocurrencies have emerged as a potential solution to these problems, offering fast, secure, and cost-effective payment options for international transactions. In this introduction, we will explore the estimated size of crypto payments for international transactions.

According to a report by Statista, the global transaction value of cryptocurrencies in cross-border payments is projected to reach $1.3 trillion by 2023. This highlights the growing interest and adoption of cryptocurrencies as a means of making cross-border payments.

One of the key advantages of using cryptocurrencies for international transactions is their speed and efficiency. Unlike traditional payment methods that can take several days to clear, crypto payments can be processed almost instantly, enabling faster and smoother international transactions. This can be especially beneficial for businesses that need to make time-sensitive payments, such as paying suppliers or employees in other countries.

In addition, crypto payments can be more cost-effective compared to traditional payment methods, as they often have lower transaction fees and foreign exchange costs. This can help businesses to save money on international transactions, which can add up to significant savings over time.

Another advantage of using cryptocurrencies for international payments is their security and transparency. The use of blockchain technology, which underpins many cryptocurrencies, provides a high level of security and transparency, making it difficult for fraudulent activities to occur. This can help to protect both businesses and individuals from fraud and cybercrime.

In conclusion, the estimated size of crypto payments for international transactions is expected to grow significantly in the coming years, driven by the speed, efficiency, and cost-effectiveness of crypto payments, as well as their security and transparency. As more businesses and individuals adopt cryptocurrencies for cross-border payments, it is likely that they will become a mainstream payment option in the international trade landscape.

The benefits of fully audited gold-backed stable coins

With the growing popularity of stablecoins, which are cryptocurrencies pegged to the value of another asset, such as the US dollar, there has been a rise in the demand for stablecoins that are backed by tangible assets such as gold. Gold-backed stablecoins offer investors the benefits of both the stability of a pegged asset and the security and intrinsic value of gold. In this introduction, we will explore the benefits of fully audited gold-backed stablecoins.

One of the key benefits of gold-backed stablecoins is their stability. By being pegged to the value of gold, these stablecoins offer a reliable store of value that is less volatile than other cryptocurrencies. This can be especially appealing to investors who are looking for a stable investment option in times of market uncertainty.

Another advantage of gold-backed stablecoins is their security. Unlike other cryptocurrencies that are not backed by tangible assets, gold-backed stablecoins provide investors with a tangible asset that can be used as collateral in case of any default or insolvency. Furthermore, fully audited gold-backed stablecoins can offer greater transparency and accountability in terms of the management of the asset and the stability of the peg.Finally, gold-backed stablecoins offer the benefits of both gold and cryptocurrencies, which can be appealing to investors who are looking for diversification in their portfolio. Gold has long been considered a safe-haven asset, while cryptocurrencies offer the benefits of decentralization, anonymity, and ease of use.

In conclusion, fully audited gold-backed stablecoins offer investors the benefits of both the stability of a pegged asset and the security and intrinsic value of gold. With greater transparency and accountability, they provide a reliable investment option for those looking for stability and security in the cryptocurrency market.

Our Research & Development

The Vital Role of Blockchain Research in Digital Payments and Exchanges

Blockchain technology promises improved security and efficiency in digital payments and exchanges. However, it demands comprehensive research before implementation.

1. Ensuring Security and Trust

Blockchain’s security benefits vary by implementation. Inadequate research can expose vulnerabilities, eroding trust. Thorough research identifies and mitigates risks, fostering user and stakeholder confidence.

2. Regulatory Compliance

Blockchain operates within complex regulatory frameworks. In-depth research is crucial to ensure compliance with evolving local and international laws, averting legal issues and penalties.

3. Technical Compatibility

Each blockchain has unique attributes. Research is essential to select the right fit, avoiding compatibility issues and unexpected costs.

4. User Experience

A seamless user experience is critical. Research guides user-friendly design and streamlined transactions, boosting adoption.

5. Cost-Efficiency and Innovation

Upfront research identifies cost-effective solutions and positions businesses for future blockchain trends like smart contracts and DeFi.

Comprehensive blockchain research is a strategic imperative. It ensures security, compliance, technical fit, user satisfaction, cost-efficiency, and long-term viability, unlocking the potential of blockchain in digital payments and exchanges.

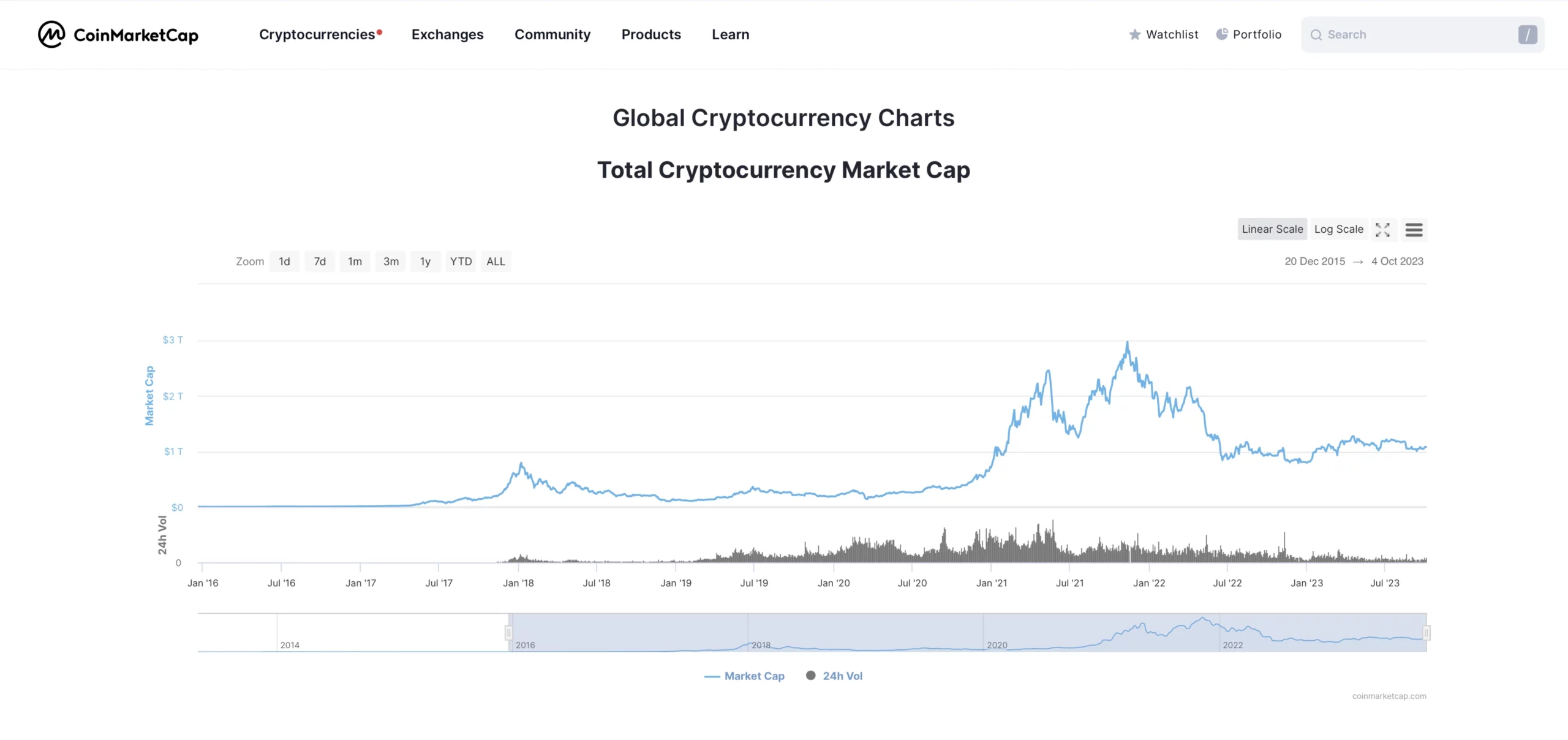

We first endorsed Blockchain in 2017, 2018, 2019, 2020…and our prediction for the future….

In the years 2017, 2018, 2019… our endorsement of Blockchain technology coincided with a a relatively modest market capitalization of just a few billion USD. During this period, Bitcoin (BTC) was valued at less than 10,000 USD, and Ether (ETH) traded at approximately 100 USD.

Fast forward to the present day, and we observe a transformative shift in the landscape. The market capitalization of digital assets has surged beyond the trillion-dollar mark, with BTC now exceeding 25,000 USD and Ether surpassing 1,500 USD in value.

We first endorsed Blockchain in 2017, 2018, 2019, 2020…and our prediction for the future….

In the years 2017, 2018, 2019… our endorsement of Blockchain technology coincided with a a relatively modest market capitalization of just a few billion USD. During this period, Bitcoin (BTC) was valued at less than 10,000 USD, and Ether (ETH) traded at approximately 100 USD.

Fast forward to the present day, and we observe a transformative shift in the landscape. The market capitalization of digital assets has surged beyond the trillion-dollar mark, with BTC now exceeding 25,000 USD and Ether surpassing 1,500 USD in value.

Our extensive research conducted over the past six years has been meticulously documented, reflecting our ability to identify key trends, including the ebbs and flows of the digital asset market capitalization, the proliferation of stable coins backed by audited fiat currencies or precious metals, the escalation of regulatory frameworks and associated costs within the digital asset ecosystem, and the recognition of blockchain as an integral component of the Fourth Industrial Revolution, championed and supported by government-sponsored industries.

Today, our outlook and predictions remain steadfast. Blockchain technology continues to hold the potential for revolutionizing payment systems by rendering them transparent and cost-effective. The adoption of stable coins, underpinned by meticulously audited fiat currencies or tangible assets like gold, is poised for further growth. The digital asset market capitalization is anticipated to remain responsive to the announcements of significant government legislations, offering traders opportunities to capitalize on the resulting volatility.

Blockchain’s impact extends beyond financial markets. Trade finance and government customs operations stand to benefit significantly from its implementation, streamlining processes and enhancing transparency. Additionally, the synergy between blockchain and artificial intelligence (AI) is poised to reshape legal frameworks, enabling more efficient interpretation and expansion.

Furthermore, blockchain gamification is on the horizon, promising experiential growth and advancement for individuals. It will not only redefine the way we conduct research but also offer immersive experiences that enrich our understanding of various subjects.

Perhaps most profoundly, blockchain is positioned to serve as the foundational structure upon which AI and synthetic biology researchers will create systems that eliminate biological misunderstandings and transcend the limitations inherent to the human body. In essence, blockchain will play a pivotal role in propelling humanity toward a future marked by enhanced capabilities and understanding.

Blockchain and Web3 Research

Projects and Research

Some of our projects and research over the last 6 years

- Creating and Developing a Digital Asset Blockchain Payments and Exchange System for Education and Deployment

- Stable Coin Blockchain testing, minting, and function review

- Digital Asset Custody System testing and integration

- Digital Asset Wallet Custody and Function testing

- POW, POS, Permission Blockchain testing and development

- Digital Asset Trading, Liquidity, Custody and Market Data Analysis

- Blockchain integration for Trade Finance. Escrow and Customs

- Regulatory Frameworks for Intl Transactions and use of Blockchain & Digital Assets

- Short Course development for Web 3 and Blockchain

- Blockchain Payments integration for existing E-commerce systems and Websites

- Web 3 Blockchain Hosting and Domains

- Tokenization of Assets and Backing of Stable Coins’

- Integration of KYC-AML process and procedure for Blockchain Digital Asset Services

- Regulatory frameworks for Fiat and Digital Assets.

Digital Innovation Focus

The Future of Payments and Asset Distribution

In light of emerging technological disruptions and their subsequent integration into established or legacy systems, it becomes incumbent upon us, the users of online payment and asset distribution systems, to maintain an ongoing commitment to strategizing for the preservation of payment continuity. To this end, we present a selection of exemplary technological advancements that can be employed to reinforce and bolster business continuity in this domain.

E-Commerce

E-commerce systems adhering to payment continuity principles integrate both Web 2 and Web 3 technologies, offering multiple merchant/custody options and a dual spectrum of payment options encompassing both fiat and digital assets.

Trade Finance and Payments

Trade Finance encompasses the various methods by which individuals and entities receive remittances in the course of commercial transactions. This encompassing definition includes activities pertaining to the initiation, receipt, generation, and exchange of digital assets. The integration of blockchain technology into Trade Finance endeavors to streamline the intricacies associated with the transfer of payments and goods. For instance, this integration involves the utilization of blockchain-based digital assets and systems designed for facilitating payments, escrow services, and customs processes.

Website production

A website serves as an extension of your company and functions as the central platform for managing incoming and outgoing payments. Websites designed with a focus on payment and digital asset continuity planning incorporate a blend of Web 2 and Web 3 systems.

About

Payment

Continuity

The Importance of Payment Continuation and Asset Distribution Planning.

In an increasingly digital and interconnected world, businesses rely heavily on payment processing services to send and receive payments from customers, partners, and suppliers. However, disruptions in merchant services or fiat banking relationships can pose significant challenges to business operations. Payment continuation and asset distribution planning, which involves diversifying payment methods and embracing alternative solutions such as blockchain digital asset payment services, is of paramount importance to mitigate these risks. This report outlines the importance of payment continuation and asset distribution planning and how incorporating various merchant fiat services and blockchain digital asset payment services can enhance a business’s ability to maintain uninterrupted payment operations and efficient asset distribution.

Payment processing is the lifeblood of any business, facilitating transactions, revenue generation, and financial stability. Yet, businesses often underestimate the vulnerability of their payment infrastructure. When traditional merchant services or fiat banking relationships are canceled or disrupted, companies can encounter various difficulties, including:

Reports and Articles

The Importance of Using Multiple Fiat Merchant Systems and Banks for Payment Continuity Planning

In today’s globalized and digital economy, businesses rely heavily on various payment systems and banking services to facilitate transactions. The uninterrupted flow of funds is crucial for the smooth operation of any company. However, relying solely on a single fiat merchant system and bank can pose significant risks to payment continuity. This report explores the reasons why companies should use more than one fiat merchant system and bank as part of their payment continuity planning strategy.

Why Payments Continuity Planning Matters

Safeguarding your business and family from disruptions in your ability to receive money and assets is paramount. Payments Continuity Planning is the strategic approach that ensures your financial interests remain secure and uninterrupted in the face of unexpected events or challenges. By implementing effective Payments Continuity Planning, you can protect your business and family from the negative consequences of payment interruptions.

The Importance of Payments Continuation Planning: Lessons from Banking Failures

The stability and reliability of the banking sector are critical to the functioning of modern economies. Banks serve as custodians of individuals’ and businesses’ funds, facilitating payments and financial transactions. However, history has shown that the banking sector is not immune to failures, which can have far-reaching consequences. This report highlights the importance of Payments Continuation Planning, using examples from past and recent banking failures, including the Credit Suisse failure and the 2023 United States banking crisis. It also discusses how these banking failures caused significant disruptions, emphasizing the need for comprehensive continuity planning.

Major Companies Accepting Digital Assets for Payments and Their Payment Continuity Planning

The adoption of digital assets for payments has expanded beyond digital asset-specific companies. Many major businesses now accept digital assets, recognizing the importance of diversifying payment options. This report highlights 19 prominent companies across various industries that accept digital assets and examines their involvement in payment continuity planning.

Education

Short Courses

Practical Short Courses Taught Online

Enroll in concise online short courses for current and practical insights. Explore topics such as Blockchain, WEB3.0, and Digital Assets, followed by an introduction to leveraging WEB3.0 services and technologies.